LePage Years Part One

Lepage years Part Two

In 2018, Amazon was looking for a location for new headquarters In an article by Wharton University, Management, it is speculated that Amazon knew all along where their new headquarters would be located: .

Lepage years Part Two

In 2018, Amazon was looking for a location for new headquarters In an article by Wharton University, Management, it is speculated that Amazon knew all along where their new headquarters would be located: .

.. Amazon received 238 proposals by the October 19 deadline from big cities like Boston, Chicago and Atlanta; smaller hip cities like Austin and Portland; gritty, nouveau-hip sites like Detroit and pre-hip Camden, N.J. (where the slogan is “Experience the Rebirth!”): regional bids like ones from Central Indiana or a three-city package in Missouri; and Northeast hopefuls betting on proximity to the corridors of power, like Philadelphia, Baltimore and Washington, D.C The Headquarters Checklist: How do Companies Pick a Location- Wharton UniversityIn November 2018, Amazon chose a city for its new location - New York, New York. awarding the biggest to the biggest. Is this a surprise? New York has a great energy for ideas and collaboration, and abundant relevant cultural classes, constantly intersecting and cross-pollinating. It's easy to believe that Amazon wanted to be in New York all along.

..... Moreover, says Thornberg, governments should not be allowed to pick and choose – ‘I’ll give subsidies to this company and not everyone else.’ That doesn’t seem kosher. It’s a corrupting influence,” he says. Thornberg would like to see a federal law that prohibits cities, counties and states from awarding individual entities special perks. The Headquarters Checklist: How do Companies Pick a Location- Wharton University238 cities across the country competed, trying to come up with the biggest tax incentives and fringe benefits of all time. if Amazon knew it wanted to locate in the Big Apple all along, did it have a strategic goal in entertaining the hopes of many cities? By strategy or happenstance, the national contest for the Amazon headquarters coincided with the enactment of the most ambitious corporate welfare legislation, in Maine's history. The Amazon contest might have instigated the idea or It could have already been in the works when Amazon waved its gold across America, enabling LePage to sell the bill to the Maine Legislature with little resistance. We must enact this bill now, so we can compete for the Amazon headquarters. No time to waste!

MRRA and Scarborough Downs submitted proposals. Both said they had everything Amazon was looking for except population size. Maine could have been developing a well targeted strategy fit to our own population size but the glamour and gold dust glistened too brightly for common sense, or fiscal conservatism, to prevail.

Officials involved in those proposals (MRRA & Scaroborough) confirmed that they were submitted on time but would not disclose the details of their offers. Portland Press Herald Maine’s in the mix as 238 places vie to host Amazon’s 2nd headquarters

The New World Order

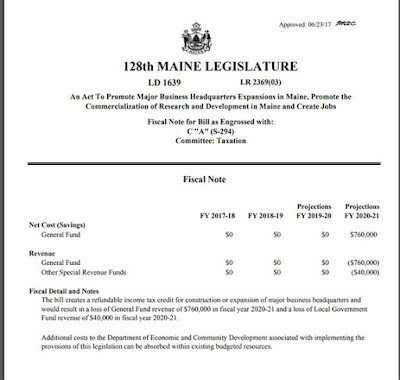

To finance the new unitary economics of the global corporate state, the Major Business Headquarters Expansion Act takes from Maine's General and Local Government Funds. This may seem like a relatively small amount today but historically Maine's economic development policies start small and are expanded later.

|

Governor LePage of Maine, Tea Party Corporatist |

|

| https://legislature.maine.gov/legis/bills/bills_128th/fiscalpdfs/FN163903.pdf |

Refundable Tax Credit + Tax Exemption= Public Taxed by Corporate State

The Major Business Headquarters Expansion Act is a refundable tax credit. It is common practice to place special refundable credits, classified as "tax expenditures", in acts separate from tax exemptions. By design, refundable tax credits and tax exemptions work together to reverse the roles of taxation for large companies, effectively granting the power of taxation to private corporations, formerly a right exclusive to government.

Maine's Pine Tree Zone tax exemptions were scheduled to expire at the end of 2018, but have been extended three more years. Governor LePage did not sign the Pine Tree Zone Extension because he wanted the tax exemptions to be extended for five years, unconcerned about the many studies which concluded that the public loses on the Pine Tree Zone tax exemptions.

The original Pine Tree Zone legislation got its foot in the door in 2004 as an initiative for Maine's low income high unemployment areas. Opposition warned that the Pine Tree Zone would soon be expanded to a state wide program, The expansion happened four years later, in 2009. I learned about the expansion on a Republican venue, which described it as passing "silently through the Legislature", meaning without media coverage, as happened with the Major Business Headquarters Expansion Act of 2017.

The Cost of Maine Corporate Welfare May Never Be Known

In March of 2013, Mr. Douglas Ray, representing the DECD, the state planning board for the FAME (Financial Authority of Maine) corporation, testified before The Joint Standing Committee on Labor, Commerce, Research, and Economic Development

Of the 390 or so businesses participating in the Pine Tree Development Zone Program a vast majority, more than 300 are manufacturers, that's roughly 80%. These businesses have pledged almost a billion dollars in investment and anticipated payroll of nearly $850 million and 74 hundred jobs.

In 2014, Jessica Hall reported for the Portland Press Herald on the ICA Report of the effectiveness of the Pine Tree Zone Tax Incentives:

…. According to the ICA report, the total value of corporate incentives was divided by the total number of newly created jobs, which provides a “rate per created job” or information on what governments “paid” for one new job. Maine awarded total incentives worth $159,000 per created job for the period from 2010 through 2013, the report found. Portland Press Herald. Pine Tree Zones tax breaks costing state more than they deliver by Jessica Hall April 14 2014Mr. Ray states that the companies have pledged to invest almost a billion dollars. 7400 jobs at $159000 per job costs the state more than a billion dollars, $1,176,600,000.00 to be exact. The average wage calculated on Mr. Ray’s figures is $114,864 annually, more than three times the median income in Maine in 2013. The price the state is paying for those jobs exceeds the private enterprise’s cost of hiring the employees by 38%.

These figures do not correlate with the figures given by New Hampshire Business Review, in October 2017:

Most states, including our neighbors, have spent tens, or even hundreds, times more in luring companies to their state, sometimes even from our state. New Hampshire has spent $8 million over the past few decades, mostly in job training grants, the fifth lowest total in the nation and the lowest in New England, according to the subsidy tracker. Over the same period, Vermont has spent $235 million; Maine, $717 million; Massachusetts, $1.1 billion; and New York — which leads the nation — $26.3 billion. New Hampshire Business Review Here’s why NH won’t land AmazonA third report came out in 2018 prices Maine's corporate welfare at over $42 million.

In August 2015, the Government Accounting Standards Board (GASB) issued Statement No .77 which requires GASB-compliant state and local governments to report on revenues lost due to corporate tax breaks.

We now know that in 2017, companies in Maine received at least $42,465,028 in various state and local tax breaks and other giveaways. (The actual figure is likely higher, since this estimate is based on a limited review of state laws and only includes 24 municipalities.) Maine Wire June 18, 2018It is probably higher also because, unlike general welfare, much of the data pertaining to corporate welfare is protected by tax privacy laws.

New Hampshire, The North East Exception

To date, New Hampshire has been a state with the independence, and freedom to take the road less traveled, but, as the New Hampshire Business Review reports, there is a tax incentive bill being considered in New Hampshire which if passed could lead New Hampshire down the same slippery slope which has transformed Maine from a state of rugged individualism to a subservient, dependent culture dominated by the wealth redistribution economy. The article in the New Hampshire Business Review gives a run down of the corporate welfare incentives enacted in nearby states, including Maine's Pine Tree Zone Tax Incentives. I once read a comment by one of Maine's oligarchy class boasting that when leaders in New Hampshire learned on Maine's Pine Tree Zone tax exemptions, they said , 'We can't compete with that!" There is nothing stopping New Hampshire from copying Maine's corporate welfare except a moral compass. I hope New Hampshire stays true to its own motto, "Live Free or Die!". The world needs options to the ubiquitous megalopolis formed around an over bearing corporate state. Those who have the guts to take the road less traveled may soon find them selves the winners as the true face of globalism loses its protective veil.

Nimble and accessible

Take Maine’s Pine Tree Development Zones program. Through it, businesses in high-paying sectors like biotech, precision manufacturing and information technology that move to or expand in Maine don’t have to pay sales and corporate taxes for five years, and 8 percent of what their workers pay in income taxes goes to them. Some 240 businesses were participating last year. New Hampshire Business Review Here’s why NH won’t land Amazon

According to the above, even without factoring the transformative effect of tax exemptions on refundable tax credits, Maine taxpayers are already paying 8% of their income tax to private corporations.

The Major BusinessHeadquarters Expansion Act of 2017

3. Refundable credit allowed. A qualified applicant is allowed a credit as provided in this subsection. A. Subject to the limitations under paragraph B, beginning with the tax year during which the certificate of completion is issued or the tax year beginning in 2020, whichever is later, and for each of the following 19 tax years, a certified applicant is allowed a credit against the tax due under this Part for the taxable year in an amount equal to 2% of the certified applicant's qualified investment. The credit allowed under this paragraph is refundable.

H. "Qualified investment" means an investment of at least $35,000,000 to design, permit, construct, modify, equip or expand the applicant's headquarters in the State. The investments and activities of a qualified applicant and other entities that are members of the qualified applicant's unitary business must be aggregated to determine whether a qualified investment has been made. A qualified investment does not include an investment made prior to the issuance of a certificate of approval or after December 31, 2022. (emphasis added)Who can compete with that? New York City can, and not just because it is a world class city but also because it is an interactive multi-cultural world city.

If Maine had landed Amazon, How much financing would Maine Tax payers have to provide Amazon?

"The qualified applicant's unitary business must be aggregated " The Major BusinessHeadquarters Expansion Act of 2017

For starters Maine taxpayers would owe Amazon a capital contribution of 16 million dollars in refundable tax credits, providing Amazon will create 1250 Maine jobs. 16 million is the current limit on the refundable tax credits, but the limits have a history of being increased over time. Because of the limit, Maine would only be financing 1.6% of Amazon's capital investments so that it would require 62.5 other cities or countries to match Maine's deal for Amazon to have 100% of its unitary capitalization covered by global taxpayers, instead of 50 at 2%. Should we thank Governor LePage and the Maine Legislature for giving us these breaks?

- Amazon disclosed in its latest quarterly report that it now owns $1 billion worth of stock in public and private companies.

- That’s up 60 percent from the year-ago period’s $623 million and a 163 percent increase from the $380 million it disclosed in the same quarter of 2016.

- It’s the latest sign of Amazon becoming a more aggressive investor. CNBC Amazon now owns $1 billion worth of other companies

The Boston Tea Party was a political protest that occurred on December 16, 1773, at Griffin’s Wharf in Boston, Massachusetts. American colonists, frustrated and angry at Britain for imposing “taxation without representation,” dumped 342 chests of British tea into the harbor. The event was the first major act of defiance to British rule over the colonists. It showed Great Britain that Americans wouldn’t take taxation and tyranny sitting down, and rallied American patriots across the 13 colonies to fight for independence. History.com The Boston Tea Party

Comments

Post a Comment