Prelude: United States codifies a centrally managed economy

|

| Image for post Bermix-Studio Unsplash |

During a few short years between 1968 and about 1971, three events occurred within the federal government that solidified the transformation of the United States economy from a dominantly free enterprise system to a dominantly wealth redistribution economy, pushing the free enterprise system to the margins.

To be sure, at that time the baby boom generation was just in its own transformative stage between the flower child of 1967's Summer of Love to 1968’s social activism explosion against war, racism, sexism, and for human rights, rock and roll and the titillating intrigue of living in a time and place dominated by a youth culture. We were not yet at that stage of life where we had leadership roles but this is where my story begins.

Our main source of news was TV, radio, and newspapers. In those days there were just three TV networks and the nightly news broadcast, no twenty four hour news coverage. The more dramatic news took center stage while behind the scenes, Congress enacted a fundamental change in the governing political philosophy of the country.

The road was paved for a centrally managed economy by the War on Poverty targeting the most distressed classes, and the National Endowments for the Arts grant program. Together they created acceptance for a centrally managed national economy, the context in which the great wealth divide grew and flourished.

In those days I did not know about The United States Intergovernmental Cooperation Act of 1968, Public Law 90–577 i. I discovered it only as of late in the process of researching another subject, on the internet, which did not exist in 1968. In my research I have found that some of the most impactful legislation is passed with little public knowledge.

The Unlimited Powers of the Federal Government

When the Union of States was formed it was established that federal (Union) powers would be limited to powers enumerated in the Constitution. Central management of the economy is not among the enumerated federal powers of the United States Constitution. None the less. the federal government has been incrementally expanding its powers since the Union was formed. Today the Federal Government controls the States through a system of wealth redistribution implemented as grants and tax incentives.

In 1968, the structural formation of national wealth redistribution was enacted

The United States Intergovernmental Cooperation Act of 1968, Public Law 90–577 i is a design to centrally manage the economy of the entire Union from the federal to the municipal level.

The following chart reveals that until the 1950’s, there was no federal government involvement with in the category of “Community and Regional Development”, which dramatically expands in the 1960’s and onward. Today it is likely that every state has a “Department of Economic and Community Development”, which is laid out in The United States Intergovernmental Cooperation Act of 1968, Public Law 90–577 as instruments necessary to receive and to redistribute grants distributed by the federal government. In Maine the Financial Authority Of Maine Incorporated collects and concentrates wealth which is distributed by the Maine Department of Economic and Community Development.

|

| Federal Grants to State and Local Governments: A Historical Perspective on Contemporary Issues |

The authors of the federal act were not shy in stating their mission as an expansion of federal powers:

|

| The United States Intergovernmental Cooperation Act of 1968, Public Law 90–577 i |

The United StaThe United States Intergovernmental Cooperation Act of 1968, Public Law 90–577 i includes detailed instructions on how State and municipal constitutions and laws should be amended to conform with federal management of the Union’s economy. Public Law 90–577 uses grants to encourage states to enact its agenda and includes instructions for keeping states informed about the availability of grants. Although parts of the federal law read as though supporting autonomy in local governance, one cannot ignore that it is the federal government instructing the States on how to manage municipalities, in an attempt to make the entire nation conform to one set of federally generated guidelines and one idea about how economic development should be achieved and the direction it should take. Forget about the antiquated idea that formed the nation of the United States, in which each state is an experiment in management and political philosophy. From 1968 onward, the entire nation would be managed at the federal level using the redistribution of wealth as its instrument.

|

| Kyle Glenn-unsplash |

|

| The United States Intergovernmental Cooperation Act of 1968, Public Law 90–577 i |

1971 Fiat Money replaces the Gold Standard

On August 15, 1971, President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, thus abandoning the gold standard. The value of fiat money rests on the claims of an accepted authority which says it exists. Today fiat money is distributed into the United States economy by the Federal Reserve.

1975 introduces the Refundable Tax Credit on a broad scale.

According to the United States Congressional Budget Office, refundable tax credits first made their appearance in 1975. A refundable tax credit means that when no taxes are owed, the taxpayers owe the credit holder a cash payment. Combined with tax exemptions refundable tax credits might be called reversible tax credits, reversing the roles of tax payer and tax collector.

The Maine Response

Over time, much of what is instructed in The United States Intergovernmental Cooperation Act of 1968, Public Law 90–577 i was subsequently enacted in Maine, which today is a state more centrally than locally managed

In the year 1976, Maine’s Governor Longley created a board composed of the heads of Maine’s largest and most powerful industries and assigned the board to lead the Legislature in executing the transformation of Maine into an economy centrally managed by the State, mirroring Federal central management of the economy and in partnership with private sector interests, thus the private sector board was assigned to lead the publicly elected Legislature.

Governor Longley’s Task Force published a report titled Legislative Recommendations of The Governors Task Force of Economic Development, dated October 1976. This report is not available online but it can be had by requesting a download from the Maine Legislative Library.

The report produced by Longley’s board identified only two objectives. One objective was to eliminate the municipal referendum on economic development bonds, authorized by the Home Rule amendment to the Maine Constitution in 1969.

2: eliminate the requirement for a local referendum on municipal bond issues. Governor’s Task Force for Economic Redevelopment-1976

Was it only a coincidence that the Maine people voted to become a Home Rule State a year after the federal government enacted a law that treats the states and the municipalities as instruments of the Federal government? The Maine Court Ruling, Smith v Town of Pittston, provides a long history and discussion of Maine Home Rule but makes no mention of the federally centralized economy enacted at the same time. It is possible that this is because there was no media light shining on the federal bill that enacted a centrally managed economy?

|

| The Home Rule Amendment was added to the Maine Constitution in 1969 |

The Home Rule Amendment was added to the Maine Constitution in 1969

Before Section 2 of the Home Rule Amendment was a part of the Home Rule Amendment, it was placed in Article IX Section 8. Equal Taxation, Marshal J Tinkle explains why:

If general obligation bonds were used so that a particular industry got back tax revenue in the form of aid, this could be equivalent to an unequal tax rate and hence in derogation of section 8. Marshal J Tinkle -The Maine Constitution: A Reference Manual

Later on in this story, as corporate welfare grows ever larger, the Supreme Court will reverse this opinion and declare that giving back tax revenue in a form of aid is not a violation of equal taxation because tax incentives are categorized as spending and not taxation.

|

| Smith v. Town of Pittston: Municipal Home Rule on: Municipal Home Rule’s Narrow Escape ow Escape from the Morass of Implicit Preemption Shane Wright University of Maine School of Law |

The words describing the function of Home Rule are true even in a centrally managed state like Maine. As much as the federal government has designs to control all, it doesn’t. The federal government has no idea of the adaptions that take place in its programs once its reaches the local level of management. The centrally managed public-private state acts as a corporation serving its own interests, getting away with what ever it can and neither honoring the intent of federal grant provisions nor responsible to the common interests of the people of Maine. as evident in the story of the Maine Capital Corporation.

A New Form of Entitlements

The Governor’s Task Force report recommended that two complimentary corporations be chartered by the Legislature, The Maine Capital Corporation and the Maine Development Corporation. The Maine Capital Corporation was the first corporation chartered by the Maine Legislature. The statement of Legislative Findings and Intent rationalized that the difficulty of Maine small businesses in finding capital makes it appropriate for the State to partner with private interests to encourage investment in Maine businesses:

CHAPTER 108 THE MAINE CAPITAL CORPORATION § 950.

Statement of legislative findings and intent

The Legislature finds that one of the limiting factors on the beneficial economic development of the State is the limited availability of capital for the long-term needs of Maine businesses and entrepreneurs. In particular, the lack of equity capital to finance new business ventures and the expansion or recapitalization of existing businesses is critical.

This lack of equity capital may prevent worthwhile businesses from being established; it may also force businesses to use debt capital where equity capital would be more appropriate. This creates debt service demands which a new or expanding venture may not be able to meet successfully, causing the venture to fail because of the lack of availability of the appropriate kind of capital. This impediment to the development and expansion of viable Maine businesses affects all the people of Maine adversely and is one factor resulting in existing conditions of unemployment, underemployment, low per capital income and resource underutilization. By restraining economic development, it sustains burdensome pressures on State Government to provide services to those citizens who are unable to provide for themselves.

To help correct this situation, it is appropriate to use the profit motive of private investors to achieve additional economic development in the State. This can be accomplished by establishing an investment corporation to provide equity capital for Maine businesses and by establishing limited tax credits for investors in the corporation to encourage the formation and use of private capital for the critical public purpose of maintaining and strengthening the state’s economy.

The rational uses a conventional truth that few will argue against, that without capital, it is difficult to grow a business, but the solution disavows the rule of law of the Maine Constitution by which It is not lawful to appropriate public resources in service of private profit motives with there being an exception for economic development at the municipal level requiring a public referendum which approves it. Home Rule aligns the community which benefits from private industry development with the responsibility for the burden of cost and authority to approve it.

The amendment (Home Rule, Section 2) makes it clear that general obligations may now be used to assist private industry for certain purposes” this section applies only to general obligations of municipalities and not to forms of financing that do not create municipal debt or liability” The Maine Constitution:A Reference manual by Marshall J Tinkle

Governor Longley’s Task Force’s objective to charter the Maine Capital Corporation arguably violates the Maine Constitution, Article IV, Part Third, sections 13 & 14 by chartering a private investment company for a purpose which can be achieved under the general laws of the State, except that general laws do not allow a private investment corporation to use special tax credits to negotiate the sale of stock. However, in the findings statement above, while the use of the profit motive is declared to be appropriate as a solution it is not categorized as the object of the corporation and so the logic does not apply to the constitutional exception. The purpose as stated is “maintaining and strengthening the state’s economy” which can be done by many other methods.

|

| Maine Constitution, Article IV, Part Third, Section 14 |

The United States Intergovernmental Cooperation Act of 1968, Public Law 90–577 i encouraged States to adapt their Constitutions, statutes, and municipal ordinances in conformity with a federalized agenda. That is easier said than done but since unconstitutional laws are still the rule of law until successfully challenged in a court of law, an easier means to the end is to simply ignore and/or over write Constitutions with statutory law.

A Refundable Tax Credit in Not So Many Words.

In 1977 a tax credit for investing in the Maine Capital Corporation is codified as §5202. The statute directly following it is §5202-A, which exempts small business investment companies from taxation.

1977

Title 36:

TAXATION

Part 8: INCOME TAXES Chapter 817: IMPOSITION OF TAX ON CORPORATIONS

§5202. Credit for investment in The Maine Capital Corporation (REPEALED)

SECTION HISTORY 1977, c. 531, §4 (NEW). 1981, c. 364, §67 (RP). §5202-A. Small business investment companies exempt Corporate small business investment companies, licensed under the United States Small Business Investment Act of 1958, as amended, and commercially domiciled in Maine and doing business primarily in Maine, shall be exempt from taxation under this Part. [1977, c. 640, §2 (NEW).]

This part was not repealed and is currently found in Maine statutes (author’s note)

§5202 does not say that the tax credit is a refundable, meaning that if no taxes are owed the holder is due a refund on his investments from the taxpayers, but since §5202-A is a 100% tax exemption for investment companies investing in Maine small businesses, §5202 makes little sense unless it is a refundable tax credit.

The MCC tax credit is placed outside of the statute chartering the Maine Capital Corporation. When the MCC was repealed §5202 the MCC tax credit was also repealed but the tax exemption in §5202-A still exists in the Maine statutes today.

Today a search for the Maine Capital Corporation, displays Title 10, Chapter 108: THE MAINE CAPITAL CORPORATION. Click on this link and it appears that the entire Act has been repealed. This Act is the “enabling legislation” referred to by the report.

However, the actual tax credit is located in two separate locations under TAXATION. The fact that the credit is listed under TAXATION is a viable legal argument that tax credits are a function of taxation and governed by Section 8, equal taxation of the Maine Constitution, none the less, as discussed later in this story, The Maine Supreme Court has ruled that tax credits are spending and not taxation and therefore equal taxation does not apply to tax credits.

When googling the Maine Capital Corporation, today, the link to §5167. Credit for investment in The Maine Capital Corporation under Title 36: TAXATION Part 8: INCOME TAXES Chapter 811: COMPUTATION OF TAXABLE INCOME OF RESIDENT ESTATES AND TRUSTS, is displayed at the top of the list. The (repealed) credit is under Taxation!

There is another section to Title 36, Part 8, which is not displayed on the Google search. Under Title 36: Part 8: Chapter 817: IMPOSITION OF TAX ON CORPORATIONS is found §5202-A, which makes small business investment companies exempt from taxation. It is placed under Section TAXATION.

The tax exemption combined with a refundable tax credit means the taxpayers will owe the holder a payment. One might argue that this is a violation of Maine Constitution, Article IX General Provisions, Section 9. Power of taxation. The Legislature shall never, in any manner, suspend or surrender the power of taxation.

The tax credit for the Maine Capital Corporation was instituted at the time when refundable tax credits first came in use. I speculate that is the reason it is not called a refundable tax credit since the language for the category had not yet been established, but by linking the credit and the exemption, it is clearly a refundable tax credit and it is also clear that a refundable tax credit is not a tax but a subsidy, which is consistent with the later Maine Supreme Court ruling categorizing returned tax revenue as spending. The fact that it is originally categorized under TAXATION supports that it’s use in giving back tax revenue to a particular industry in the form of aid is equivalent to an unequal tax rate and a derogation of Section 8. The placement of an early refundable tax credit under the statutory TAXATION section supports that subsidies are taxation.

The Review Concludes that MCC does not meet the purpose of its enabling legislation but does not consider the enabling Constitution

The chartering statute of MCC called for a review of the Maine Capital Corporation in 1984 to determine if the corporation was consistent with the purpose of its enabling legislation. Neither the original report by the Governor’s Task Force of 1976 nor the 1984 report of a study by the Joint Standing Committee on Taxation to the 111th Maine Legislature considered the consistency between the Maine Capital Corporation and the Maine Constitution, the enabling authority for Maine statutory law.

The 1984 legislative report is an evaluation of how the purpose of the law, which enabled the charter of the Maine Capital Corporation in the alleged interest of Maine small businesses, was met in practice.

Both the majority and minority opinions of the Joint Standing Committee, agreed that the purpose of the enabling act of legislation had not been met and stated that the purpose of the Maine Capital Corporation was no different from that of most venture capital firms throughout the nation.

And so it was acknowledged that the object of the Maine Capital Corporation did not satisfy the Maine constitutional exception to Article IV Part Third Section 14, that the object of the corporation could not be obtained other than by a special act of legislation. However since the Maine Legislature did not consider whether or not MCC was consistent with the Maine Constitution, this did not factor in to the object of the report.

Although the stated primary goal of the Maine Capital Corporation is not the same goal as stated in the enabling legislation, the primary objective of the MCC is no different from that of most venture capital firms throughout the nation. According to Venture Economics, “The primary motivation for venture capital investment is to achieve very large capital gains for investors.” By depending upon a strictly private venture capital investment company which has obligations to stockholders and no State imposed performance standards as a means to promote economic development of the State, the State of Maine has accepted the premise that the injection of venture capital in the Maine economy, is itself, a public benefit and promotes economic development. The more pertinent issue in this case may be the degree of effectiveness of a private, Maine based venture capital firm in providing needed capital to the Maine economy. report of a study by the Joint Standing Committee on Taxation to the 111th Maine Legislature

The report goes on to conclude that the corporation had significant potential and should be given the opportunity to realize that potential by taking away the limit on capitalization and remove the requirement that the geographical area be limited to Maine. The report does not identify what the potential is or whom it benefits. To avoid the danger that the geographical expansion would result in investments concentrated outside the state, it was recommended that a percentage of the increase in investments be reserved for Maine.

|

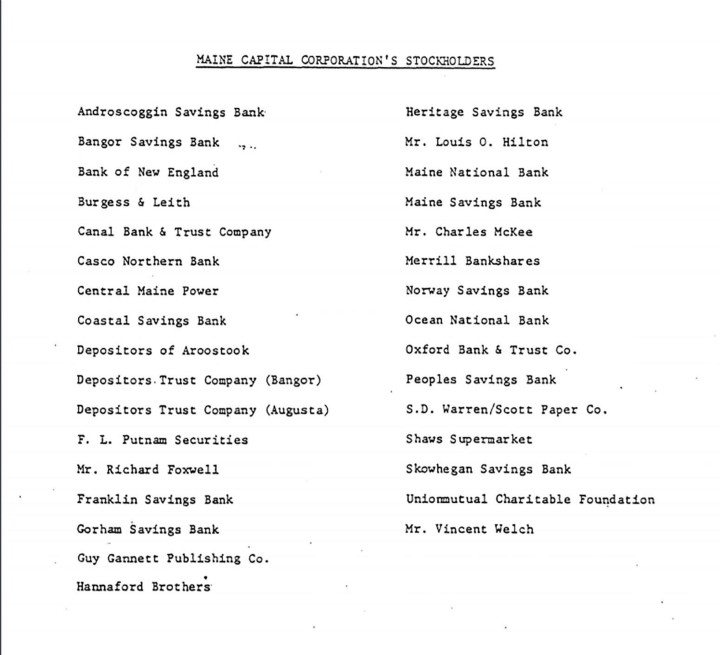

| The Tower of Power: Original stockholders, 6 individuals, 6 corporations, and 19 banks |

The original law creating the MCC limited the income tax credit provision to “subscribers in the common stock of the Maine Capital Corporation.” The Attorney-General’s office interpreted “subscribers in the common stock” to be the initial investors in the Maine Capital Corporation. According to this opinion, “ … a transferee purchasing stock from a subscriber is not a subscriber, and thus, the credit cannot extent to transferees. report of a study by the Joint Standing Committee on Taxation to the 111th Maine Legislature

|

| Servants of the Tower |

No explanation is offered for the interpretation of the Maine Attorney General’s Office. In this author’s lay opinion, additional words within the Constitution are required to support the Attorney General’s interpretation of “subscribers in the common stock” as intending “Initial investor”. If the intention of the statutory charter is that “subscribers” means the group that initially formed the corporation, it should be stated in plain english. The word “common” conveys “common to all”. There are no definitions provided in Chapter 108, The Maine Capital Corporation, to support the interpretation that “subscribers in the common stock” intends a preferred group of stockholders such as “initial investors”. What is a Common Shareholder?

What is a Common Shareholder?

A common shareholder is an individual, business, or institution that holds common shares in a company, giving the holder an ownership stake in the company. This will also give the holder the right to vote on corporate issues such as board elections and corporate policy, along with the right to any common dividend payments. Investopedia definition

|

| Chapter 108, The Maine Capital Corporation, Section 952 |

A motivation for the Attorney General’s interpretation may have been that when the tax credit is transferred with a private sale of stock, it can be argued that the Maine Legislature surrenders the power of taxation to the Maine Capital Corporation. Such a transference is arguably a violation of the Maine Constitution, Article IX General Provisions, Section 9. Power of taxation. The Legislature shall never, in any manner, suspend or surrender the power of taxation.

The Legislature shall never, in any manner, suspend or surrender the power of taxation Maine Constitution, Article IX General Provisions, Section 9. Power of taxation.

The enabling law of 1979 extended tax credits to subscribers of the common stock of the Maine Capital Corporation. 1981 legislation defined the tax credit as applying to any stockholder in the corporation, consistent with the Maine Constitution, Article IX, Section 8

Maine Constitution Article IX Section 8. Taxation. All taxes upon real and personal estate, assessed by authority of this State, shall be apportioned and assessed equally according to the just value thereof.

The original stockholders took objection to the change for reasons not explained in the Joint Standing Committee report. The possibility that the act of MCC selling stocks with the tax credits is a transference of the power of taxation from the Legislature to a private investment company, may be a factor in why there is no provision in the MCC charter governing the transference of the tax credit, when the stock is sold.

As a result of its investigation, the Joint Standing Committee on Taxation discovered that the enabling legislation and income tax credit provisions were amended in 1979. In the process of revising the income tax credit provisions to facilitate administration of the tax credits, the Legislature may have inadvertently expanded eligibility for MCC tax credits. Initially, only the original subscribers of MCC stock were eligible for tax credits, but currently, any investor in the corporation may qualify for the credits. The Committee unanimously recommends revision of the income tax credit to apply only to the original subscribers.THE MAINE CAPITAL CORPORATION Report of a Study by the JOINT STANDING COMMITTEE ON TAXATION

In the section, above, it is suggested that changes enacted by the Legislature to extend the tax credits, on an ongoing basis,“may have been inadvertent”. How conscientious is the law-making body that makes such changes accidentally? It is more likely that it was done intentionally.

|

By restricting the tax credits to the original stockholders. it can be interpreted as serving the interests of an oligarchy and violating the principles of equal taxation. The inescapable problem was that public-private corporations are unconstitutional within the parameters of the Maine Constitution, taken as a whole design,

rather than broken up into a collection of individual and unrelated parts.

When considering the Maine Constitution as an interrelated whole, it was

impossible for the Maine Capital Corporation to be consistent the Maine

Constitution. For taxation to be equal, the Maine Capital

Corporation would have to be the authority with the power of taxation, to grant it equally to all shareholders, if taxation is interpreted as inclusive of taxation benefits. Otherwise, the MCC would have to qualify as a state corporation,

which is unconstitutional by Article IV Part Third Section 14 of the Maine

Constitution. Even as a state corporation, the Legislature would have to be the authority selling the stock, with tax credits attached, to be consistent with Section 9 of the Maine Constitution. where it is mandated that the

Legislature shall never transfer the power of taxation. The fact that the MCC

was selling stock with tax credits clarifies that credits, later classified as spending, and not taxation, by the Maine Supreme Court, is in fact a

function of taxation, which is a function of the State. The tax credits are transformed into subsidies by the tax exemption provided in §5202-A, listed under taxation in the statutes.

A function of the tax exemption transforms the tax credit into a subsidy (spending by the State), and so the subsidy is a function of the tax exemption, which is categorized as taxation. |

Maine Courts strike down constitutional challenges to corporate welfare

It is arguable that the intent of equal taxation requires that the distribution of benefits be included in the measure of apportionment, but recent Maine court decisions do not agree, particularly when it comes to economic development and corporate welfare. The courts support the argument that distribution is not relevant to taxation, concluding that if everyone is taxed equally but some receive their tax payments back in refundable tax credits, it is equal taxation because refunded tax credits are categorized as distribution or spending, and not taxation. The fact that some taxpayers must cover the cost of returning money paid in taxes paid back to other taxpayers does not factor into the court’s opinion.

MAINE SUPREME JUDICIAL COURT

Reporter of Decisions

Decision: 1998 ME 246Docket: Ken-98-342

Argued: November 3, 1998

Decided: November 23, 1998

PANEL: WATHEN, C.J. and CLIFFORD, RUDMAN, DANA, SAUFLEY, ALEXANDER, and CALKINS, JJ.

ORLANDO E. DELOGU et al.{1}

v.

STATE OF MAINE et al.{2

} II. THE CONSTITUTIONALITY OF THE CREDIT ENHANCEMENT TIF

[¶17] Article IX, section 8 of the Maine Constitution requires that "all taxes upon real and personal estate, assessed by authority of this State, shall be apportioned and assessed equally according to the just value thereof."

Thus, all property taxes assessed must be assessed on an equal basis. McBreairty v. Commissioner of Admin. & Fin. Serv., 663 A.2d 50, 54 (Me.1995). The trial court held that the City of Bath's reimbursement to BIW of property taxes directly attributable to the project does not violate this requirement.

[¶18] BIW will be assessed and pay property taxes on equal terms with all other taxpayers in the City of Bath. The reimbursement to BIW is a distribution of tax revenues. A critical distinction exists between the assessment of taxes and the spending of tax revenues. As we held in McBreairty:

Although Article IX, Section 8 requires equal assessment of property taxes, it does not apply to the manner in which the government chooses to spend its tax revenues. There is no requirement that the Legislature distribute tax revenues equally.McBreairty, 663 A.2d at 55 (citation omitted). Consequently, the reimbursement of the taxes to BIW by the City of Bath does not violate

Refundable tax credits are a staple of Maine corporate welfare, which is the foundation of State economic development policies. The courts accept the interpretation that job creation by large corporations is for the public benefit, although the same does not apply equally to businesses of all sizes. It means that if no taxes are owed the taxpayers owe the holder a payout. Maine tax exemptions can reduce taxes up to 100%. There after refundable tax credits reverse the roles of taxation so that the tax payer becomes the tax collector.

Although there is a reasoned basis for distinguishing between taxation and spending, when it comes to the intent of the law, the Constitution is the ultimate reference and one must take the whole of the Constitution into consideration when interpreting its intent. Laws are written in one time and interpreted in another. As brilliant as the original founders may be, they cannot fore see every future development which will unfold.

Maine Supreme Court Progressivism

In the Maine Constitution, a Reference Manual, Marshal J Tinkle writes:

In the late nineteenth centuries, the Law Court evinced more concern for economic rights, and under the “takings” clause and taxing power clause struck down legislation that promoted private industry at the expense of property owners or tax payers. This approach harmonized with the national trend, but the Maine court went further in restricting state as the Law Court has increasingly deferred to legislation in reviewing a wide variety of regulatory schemes and funding projects. In rationalizing this turnabout, the Justices have explained that they had “interpreted our Constitution as a live and flexible instrument fully capable of meeting and serving the imperative needs of society in a changing world” (Opinion of the Justices, 231 A. 2D 431, 434 {ME 1967}).

|

The concept of the

Constitution as a living and flexible instrument is the philosophy of

progressivism, as opposed to that of judicial precedence. 2. A municipality should be defined by statute as legally equivalent to a local development corporation for the purposes of allowing the MGA to guarantee municipal revenue bonds. Current law requires a local development corporation to hold title in order for an industrial loan to be eligible for a guarantee. This is incompatible with the requirement that the municipality hold the title to be able to issue an industrial revenue bond. - 22- This change would eliminate the need for a municipality to take an extra legal step in the process of obtaining new industry. The 1976 Report, Legislative Recommendations on the Governors Economic Development Task Force of 1976 |

Section 14. Authority and procedure for issuance of bonds. The credit of the State shall not be directly or indirectly loaned in any case, except as provided in sections 14-A, 14-B, 14-C and 14-D. The Legislature shall not create any debt or debts, liability or liabilities, on behalf of the State, which shall singly, or in the aggregate, with previous debts and liabilities hereafter incurred at any one time, exceed $2,000,000, except to suppress insurrection……. Maine Constitution Article IX. General Provisions

That seems very straightforward through the use of the words “directly or indirectly” and “shall not create any debt or debts, liability or liabilities, on behalf of the State” but the Maine courts have suggested that it is very difficult to interpret and go into long treatises about how other states interpreted their constitutional debt limitations, although Maine is not governed by the Constitutions of others states but by the words in our own Constitution.

In Common Cause v. State 455 A.2d 1 (1983)

involving bond funding of Bath Iron Works, the plaintiffs alleged that:

(1) that the use of public funds in the manner contemplated by the agreements would amount to taxation for private purposes in violation of the Maine and United States Constitutions;

(2) that the incurring of debt by the state for the benefit of BIW, as provided for in the agreements, is a lending of the state’s credit prohibited by article IX, section 14 of the Maine Constitution; and

(3) that the issuance of bonds for the purpose set forth in the agreements was not authorized by the electorate of Maine as required by article IX, section 14 of the Maine Constitution.

The courts asserted that by the term “credit, directly or indirectly loaned”, the Maine Constitution intends “suretyship”, to which I argue that if the Constitution meant suretyship, it would say suretyship.

However the 1983 Maine Supreme Court used its own assertion that by “credit”, the Maine Constitution meant “suretyship” to argue that there is not “slightest hint that the section, by authorizing limited surety debt, was intended to foreclose otherwise permissible direct state debt.” Did the Court not read the whole of Section 14A which also says ” The Legislature shall not create any debt or debts, liability or liabilities, on behalf of the State, which shall singly, or in the aggregate, with previous debts and liabilities hereafter incurred at any one time, exceed $2,000,000"?

The plaintiffs argue that article IX, section 14-A of the Maine Constitution is the exclusive route for state funding of economic development projects. That section authorizes the Legislature to insure payment of mortgage loans on real estate and personal property of industrial, manufacturing, fishing, agricultural and recreational enterprises, and to issue bonds on behalf of the state for that purpose.[40] The argument is unpersuasive. Neither the text of section 14-A nor the legislative debates preceding its original adoption in 1957 contain the slightest hint that the section, by authorizing limited surety debt, was intended to foreclose otherwise permissible direct state debt. See 2 Legis.Rec. 1963–64, 2312–15, 2335–38, 2509–14 (1957).

That was a Supreme Court decision, which one might think is the court of last resort, which it is in that particular case, but Marshall J Tinkle is the Maine Legislature’s recommended constitutional author and he reports on earlier precedences that the 1983 ruling ignored. There is hope that another court can return to the former precedence as its guidance.

As written in Marshal J Tinkle’s book, earlier court precedents weighed in on what is referred to as “otherwise permissible direct state debt” in the 1983 ruling. Tinkle writes that, previously to the Home Rule Amendment, the courts ruled against general obligation bonds being used to benefit a particular industry:

“If general obligation bonds were used so that a particular industry got back tax revenue in the form of aid, this could be equivalent to an unequal tax rate and hence in derogation of section 8. Marshal J Tinkle -The Maine Constitution: A Reference Manual”

The Importance of the Preamble

In interpreting the intent of constitutional law, the Preamble is crucial to understanding its intent. The Preamble of the Maine Constitution expresses reliance on the guidance of the “goodness of the Sovereign Ruler of the Universe”:

Maine Constitution PREAMBLE.

Objects of government. We the people of Maine, in order to establish justice, insure tranquility, provide for our mutual defense, promote our common welfare, and secure to ourselves and our posterity the blessings of liberty, acknowledging with grateful hearts the goodness of the Sovereign Ruler of the Universe in affording us an opportunity, so favorable to the design; and, imploring God’s aid and direction in its accomplishment, do agree to form ourselves into a free and independent State, by the style and title of the State of Maine and do ordain and establish the following Constitution for the government of the same.

The Preamble to Maine’s Constitution is written with words similar to those of the United States Constitution but the term, “general welfare” has been transposed as “common welfare”. Speculatively, at the time the Maine State Constitution was created, the term “general welfare” may have presented a wide and problematic range of interpretations.

The term “common welfare” is more specific. Common welfare is commonly shared by all. Thus the Maine State Constitution identifies the object of government as limited to promoting welfare which is shared commonly by all.

The goodness of God is called upon as a guide in achieving the objects of government. The goodness of God is a philosophical concept quite different than central management by a State. God is a belief in a higher understanding than that of the mortal man. The State is government by mortals. The Preamble of the Maine Constitution defines the object of government as promoting benefits commonly shared by all and guided by a faith in an understanding-transcending that of mere mortals. If one is to take this for what it is worth, based on the Preamble of the Maine Constitution, alone, central management of the economy by the State is unconstitutional.

A constitutional prohibition against State corporations

The Maine Constitution, Article IV, Part Third Section 14 is more specific in prohibiting the Maine Legislature from chartering corporations by special act of legislation, with exceptions for municipal purposes and if the object of the corporation cannot be achieved another way.

The MCC Report Details and How it failed in fulfilling its purpose

The MCC enabling legislation defines the object of the Maine Capital Corporation as growing small business and rural economic development in the State. Economic development can be done by means other than government, such as within the free enterprise economy and by diversified resources and so does not satisfy the constitutional exception for “an object of the corporation which cannot otherwise be attained” As the report reveals very little economic development was attained by MCC which used the tax credits to benefit the stockholders and in 1984, had invested in only three businesses, one of which went bankrupt there after.

|

THE MAINE CAPITAL CORPORATION Report of a Study by the JOINT STANDING COMMITTEE ON TAXATION to the 111th Maine Legislature January, 1984 |

The Maine Capital Corporation’s enabling legislation’s parameters of economic development included:

1. Develop or promote development of new businesses

2. Promote viable business expansions

3. Encourage capital reinvestments

4.. Reduce unemployment

5. Increase per capita income.

Contrarily, the primary objective of the Maine Capital Corporation according to the MCC brochure is:

“to create long term capital appreciation for the venture’s stockholders and for Maine Capital Corporation Page 4 of the MCC Report by Joint Standing Committee

With only $200,000.00 of a total $1,000,000.00 invested in Maine small businesses, reported in the 1984 report, by June of 1983 MCC had invested $800,000.00 in interest-earning accounts in its own shareholder’s banks.

The Maine Capital Corporation also “ invests idle cash in certificates of deposit and money market accounts with shareholder banks. As of June 30, 1983, these investments were approximately $800,000, and income from those investments for 1983 was $95,000.” report of a study by the Joint Standing Committee on Taxation to the 111th Maine Legislature

Beldon Hull Daniels Opinion

The Oversight Committee hired the Beldon Hull Daniels firm to produce a report studying the effectiveness of the Maine Capital Corporation. A report entitled, Maine Small Business Development Finance by Belden Hull Daniels, presents a detailed and relevant discussion of the Maine small business economy, while the Oversight Committee report deals only with how to attract investors to the Maine Capital Corporation and makes no recommendations relevant to measuring the effectiveness of the Maine Capital Corporation on Maine economic development.

The Daniels report concluded that

MCC believes that it cannot compromise its expectations of return or any other investment criteria when looking for ventures in Maine. This would suggest that only expected returns in the range of 25–30 percent would be acceptable to MCC. Maine SmallBusiness Development Finance by Belden Hull Daniels.

The Daniels report questions whether the primary objective of MCC is consistent with the objective in the enabling law and does not agree with the Joint Standing Committee’s central premise, that, “what is good for Maine capital is good for the State of Maine.”, finding that the MCC was overly generous to the stockholders.

The Belden Hull Daniels report argues that the MCC looks for a minimum rate of return of 25 to 30% on its investment. Furthermore, the Daniels report asserts that this rate of return is substantial compared to the actual investment of $500,000 by the stockholders. The 50% income tax credit reduces the $1,000,000 investment to $500,000 and increases the effective rate of return to 50–60 percent. “Maine Small Business Development Finance by Belden Hull Daniels.

The Daniels report strongly urged that the MCC be made accountable to the State with respect to the purposes established in the law, suggesting minimum standards and goals be included in the law, such as the number of new jobs to be created, for investors to qualify for the tax credit. Those ideas were not applied to the Maine Capital Corporation but were incorporated into later State economic development benefits wherein the State trades ever escalating corporate benefits for x number of “quality jobs” whereby “quality” is exclusively measured by rate of pay and benefits.

The Standing Committee dismisses the Daniels Report conclusions

The Standing Committee report reduced the measure of Maine economic development to simply creating attractive terms for investors in the Maine Capital Corporation. Although the Daniels report is a comprehensive analysis, the Daniels report was all but ignored by the Standing Committee as the solutions recommended by the Joint Standing Committee addressed only the interests of investors in MCC. There are no recommendations given by the Committee to assure that the Maine Capital Corporation grew Maine’s small business economy.

In the first year of operation, the MCC contracted with the Maine Development Foundation which agreed to provide facilities and personnel to the venture capital firm at a rate not to exceed $65,000 per year. Using the administrative and staff resources of the Maine Development Foundation the MCC made its first investment of $52,000 in a firm entitled Cabletronix in Rockland. In June, 1981, Cabletronix fi1ed for bankruptcy. report of a study by the Joint Standing Committee on Taxation to the 111th Maine Legislature

The Maine Development Foundation was chartered by the Maine Legislature at the same time as the Maine Capital Corporation was established. The Maine Development Foundation still exists today. It’s board members are found on the most influential boards across the State. Today much of the state is run by boards, opaque to the general public. Boards generally hire managers or staff who interface with the public while answering to the board. The managers and staff are the humanistic interface with the public, listening and interacting with the concerns of the public, but do not necessarily reflect with the views of the one-step-removed-from-the-public board. The board most likely co-ordinates with the State on requirements for grant distribution to the local organization much of which is handed down through the federal government and governed by a federally mandated agenda.

The Maine Capital Corporation was repealed in 1994 with a Statement of Fact that it had fulfilled its original public purpose. The repeal of the Maine Capital Corporation was coordinated by the Joint Standing Committee with the ending of the tax credits. Once the tax credits no longer existed, it was said there was no further purpose to be fulfilled by the Maine Capital Corporation. The Joint Standing Committee recommended that the Maine Capital Corporation be converted to a corporation operating under Maine general law.

A request to the Maine Legislative Library brought up no further reports of investments in small businesses by the Maine Capital Corporation. The only report on its activities that I was able to find in state records was the 1984 review. There are several annual reports listed on the Secretary of State website showing that the MCC was dissolved in 1995. I am continuing to dig around for records, however, I am of the opinion, that if the Legislature chartered the MCC as an economic development initiative and provided tax credits to its stockholders, there should be some accountability by the Legislature as to what happened with this economic development project, especially after it was allowed to continue with stockholders collecting tax credits for ten years after its first failed review. The Act of Repeal states that it has met its purpose, if so, why was there a need for a vast network of State economic development corporations chartered in its wake?

My family’s business was one of those small businesses which had difficulty finding investment capital, the reason for establishing the centralized economy. Around about that time our business was expanding. My father said it would be easier to find capital if he were seeking a larger amount. After many years of researching the Maine economic development system, a product of the centrally managed economy, my Dad’s point is evident. At every turn the system advantages those with money over everything else. By exchanging corporate welfare for x number of “quality jobs” paying above average wages and benefits, the system literally subsidizes the upper crust of the economy at the expense of the whole economy. Taking only that one simple fact, it is no mystery why, as the centralized economy grew, the wealth divide expanded.

In 1968 it would have been much more difficult to do the research In this story, The internet makes information more accessible . Today there is twenty four hour news and many news resources. This has both positive and negative effects and one must be aware of both but the upside is that it is possible for many more voices to be heard. There is propaganda everywhere but that means people will become smarter about it. In some phases, naivety will fade away and the general public will become more sophisticated. Meanwhile coronavirus is impacting everything we once took for granted. A new world is forming. Let is be a better and a wiser one.

Originally published at https://www.datadriveninvestor.com on July 13, 2020.

Gain Access to Expert View — Subscribe to DDI Intel

Comments

Post a Comment